by Mansour Salame | May 20, 2016 | Inside Sales, Inside Sales Team, Sales Management, Sales Process, Startup Growth

A software startup in Silicon Valley is tracking to beat $3 million in revenues in its first full year of operation. It is time to come up with a sales plan for next year. The board had been encouraging the CEO to ‘“step on the gas” and aim for $9 million next year.

The CEO, CFO, and VP of Sales gather around the polished glass table in the newly redecorated conference room to finalize the business plan for the next year. The CEO gets the ball rolling, “So is everyone comfortable with this plan to reach $9 million next year?” The VP of Sales says he’s onboard, but that tripling sales will also mean tripling the sales team. The CFO chimes in saying that means 16 new hires in sales — another ten account execs and six more SDRs — and 14 new hires in other departments to support the growth.

The board approves the aggressive growth and sales plan and the required spending. They congratulate themselves that now they can raise an up round to support the growth, and the hiring spree begins.

The first quarter results are a near miss, but the company manages to close its round of funding based on the growth plan. The second quarter results diverge even more from the sales plan. When the third quarter results show annual sales growth is “only” 90% to date, the VP of Sales is called on the carpet to explain, and all he can offer is that it’s taking more time than expected for the sales team to hit their stride. What went wrong?

B2B giant salesforce.com has made growth look easy, mushrooming into a $7 billion company in just 15 years since it was launched. But planning for growth is never that easy, especially for B2B tech startups. The above scenario is actually quite common in Silicon Valley, as new firms are often pushed to grow faster than they should. According to the Startup Genome Report 92% of Startups fail and 74% of those failed due to premature scaling, ie hiring and spending money on sales and marketing before they are ready to. Mark Leslie and Charles Holloway break down the whys and wherefores of the “Organization sales learning curve” in their seminal 2006 article in HBR.

Sales Plan: The Sales Learning Curve

When you dig into cases where sales growth does not even come close to expectations, you often discover the real problem is that the sales team was not performing at capacity before the ramp up. One common situation is that you meet sales goals your first year because two of your five sales reps are crushing their quota, but your other three reps are underperforming. Then in year two, your two superstar reps also start to underperform. Why? Because the CEO had been feeding them prime leads and deals, and the easy deals are all gone now.

If your sales team is not really performing, then adding five new AEs will not result in doubling sales bookings, but more likely in eight or nine reps not making their quota.

If your sales team is not really performing, then adding five new AEs will not result in doubling sales bookings, but more likely in eight or nine reps not making their quota. You must be certain you can actually derive value from a larger team before adding sales capacity.

The recent boom and bust of managed benefits startup Zenefits is an instructive case in point. After a very strong year in 2014, Zenefits CEO Parker Conrad promised investors 1000% growth in 2015, raised $583 million and commenced a gigantic hiring spree. Unfortunately, the ramp up at Zenefits did not produce the promised results, with the company “only” managing 300% growth in 2015 and Conrad losing his job (although some have argued that he lost his job due to compliance issues).

Analyze Your Sales Capacity Utilization before Hiring

If you are going to avoid a situation like Zenefits, you need to get a firm grip on your actual sales capacity, that is, the efficiency and effectiveness of your sales team.

All too often planning for sales teams just involves taking the assumed average quota by rep and multiplying that figure by a given number of reps to match the current financial plan. The thinking goes “if we got $3 million in sales bookings last year with an eight-people sales team, just double up to 16 and we will hit our $6 million goal.”

The problem with this kind of generic sales plan for growth is that if your actual metrics are below your assumptions for more than 25% of your reps, you still have a lot of unused capacity, and bringing in more reps will not result in increased sales. In this case, instead of increasing headcount, you need to work on improving the efficiency of your sales process.

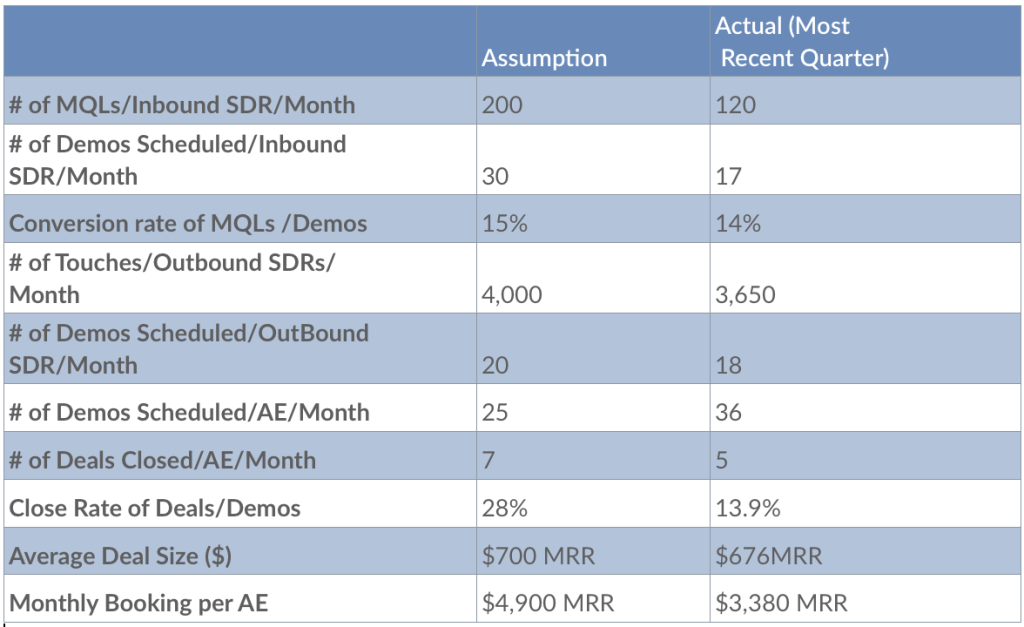

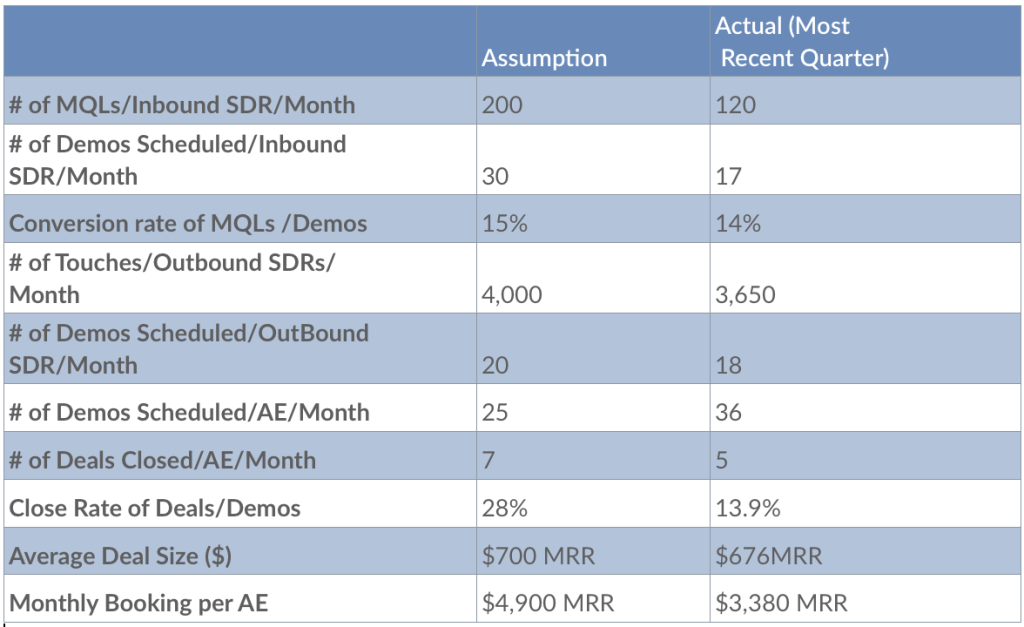

The table below offers an example of sales model metrics for a growing SaaS startup.

The above metrics show that the sales team is operating below capacity. To increase sales bookings and achieve better sales capacity usage, you need to consider:

– If your inbound SDRs are not consistently receiving 200 marketing qualified leads a month, you need to work with marketing on increasing the number of leads generated before adding additional inbound SDRs

– If the close rate of your AEs is less than 20%, then you are better off investing in coaching or training your reps to improve their effectiveness than hiring more AEs.

– If your outbound SDRs are not performing 200 touches a day, then ponying up for a sales acceleration tool or Power Dialer to consistently increase their activity levels is clearly a worthwhile investment.

Before ramping up your team, you also need to ensure that your sales model metrics are not skewed by one or two “superstar” reps who are masking poor performances by other reps.

The overall efficiency and effectiveness of your team will inevitably slip when you onboard new reps. That’s why the whole idea that you just expand your team and sales metrics will improve is flawed. You may have to do both: increase your sales capacity and improve the utilization of that increased capacity. But with that comes increased risk.

According to entrepreneur and tech venture capitalist Jason Lemkin, the best way to gauge the health of your startup is to monitor the production of qualified leads. Lemkin introduces the concept of “Lead Velocity Rate”, that is, your growth in qualified leads measured month over month. This argues that you shouldn’t increase the size of your sales team until you achieve aa Lead Velocity Rate that can support a larger team.

Growth is a Journey of increasing demand and capacity. Too many B2B Tech companies, especially venture back ones, make the mistake of increasing capacity without paying enough attention to improving the utilization and demand of their capacity. More often than not this does not translate into the expected growth in sales and meeting the sales plan.

by Kate Volodko | Apr 26, 2016 | FrontSpin Product, Inside Sales, Inside Sales Team, Sales Management

Distraction limits efficiency. This inescapable fact of human nature is too often ignored by employers, as they frequently sabotage their own efforts at creating more efficient processes by overloading employees with a variety of different tasks.

Context switching, or the process of mentally switching gears from one task to another, takes time. Some psychologists have even likened the process to a computer reset, as a new task requires the brain to take the time to “recontextualize” to the new situation and expectations.

Most people, especially strong multitaskers, claim they hardly notice the brief mental processing delay, but it can be measured, and this processing delay can add up to a significant amount of time over a full shift, especially if the sales rep is frequently changing between a number of disparate tasks.

Focusing on more than one thing decreases productivity by 40% and lowers IQ by 10 points, according to Harvard Business Review. It also leads to a loss of 2.1 hours a day.

It might be hard to believe, but according to Gloria Mark, Professor of Informatics at the University of California, Irvine, her research shows that information workers (i.e., salespeople) switch tasks every three minutes and five seconds on average. Moreover, close to half of these context switches were actually “self-interruptions”.

Reducing/Mitigating Context Switching

Larger employers are becoming increasingly aware of the costs of context switching, and many have begun to fine tune their operations to minimize context switching and prevent their sales reps from losing focus.

Thoughtful scheduling of a rep’s daily activities can help in minimizing context switching. For example, a sales development rep on an inside sales team might spend the first hour of her day cleaning up leads and resolving problems, then she logs into her sales communication tool and puts in three hours sending emails working to qualify leads. After lunch, she’ll reach out to leads using an auto dialer like FrontSpin for three hours or so, and spend the last hour of her day responding to emails and finalizing qualified leads to pass on to the account exec team.

Grouping calls is another way to minimize context switching. One idea is to group calls by roles, so sales reps can focus on the same messaging for the same buyer personas and not have to mentally switch gears.

With this kind of block scheduling and carefully considered grouping of calls, you can make sure that your team is exposed to minimum distractions so they can get more work done. The use of an integrated sales communication tool and autodialer also means the employee is switching to a designated work environment that encourages staying on task.

Not surprisingly, a growing number of sales managers are turning to technology in their efforts to streamline their operations and improve rep productivity. The latest sales communication & acceleration tools and auto dialers offer a ton of useful features to save time and improve productivity.

Sales Communication Software and Auto Dialer Improves Focus, Improves Productivity

Sales communication & acceleration platforms and auto dialers continue to evolve, and most of the new features are aimed at eliminating unnecessary work and distractions, so that sales reps spend more of their time contacting customers and closing deals.

An integrated, multi-modal sales tool that includes an auto dialer should allow reps to more than double the total number of email or phone contacts made during a shift, dramatically increasing productivity and resulting in more, higher-quality leads and more opportunities for account execs.

An integrated, multi-modal sales tool that includes an auto dialer should allow reps to more than double the total number of email or phone contacts made during a shift, dramatically increasing productivity and resulting in more, higher-quality leads and more opportunities for account execs.

The latest generation of sales communication solutions have significantly leveraged the value of an inside sales team. Technology has made it possible to integrate a number of tasks into a single interface, enabling the development of a more effective sales process, and giving your team the tools it needs to rapidly qualify prospects and close more deals.

Forward-looking sales managers are closely tracking the technology-driven sea change that is hitting the inside sales world today, and are taking steps to ensure their sales teams have the productivity tools they need to succeed.

by Mansour Salame | Apr 14, 2015 | Inside Sales, Inside Sales Team, Sales Management, Sales Process

I’ve started several startups and advised countless others. One thing, however, has remained constant: friction between sales and marketing.

Sales is seldom satisfied with the quality and quantity of incoming leads, while marketing complains about sales doing little with the leads it already has.

Most of the times, this friction stems from an inability to define where marketing ends and sales begins. Sales is seldom satisfied with the quality and quantity of incoming leads, while marketing complains about sales doing little with the leads it already has. Do not think for a moment that this conflict is limited to startups. I’ve served on the boards of large companies where VPs of Marketing and the VPs of Sales have literally fought over the quality of leads.

The first step in reducing the friction between sales and marketing is to come to a clear definition of a Sales Qualified Lead (SQL), since this is where the hand-off from marketing to sales takes place.

In this post, I’ll help you understand what makes an SQL and put a figure to the percentage of SQLs a well-performing sales team should be closing.

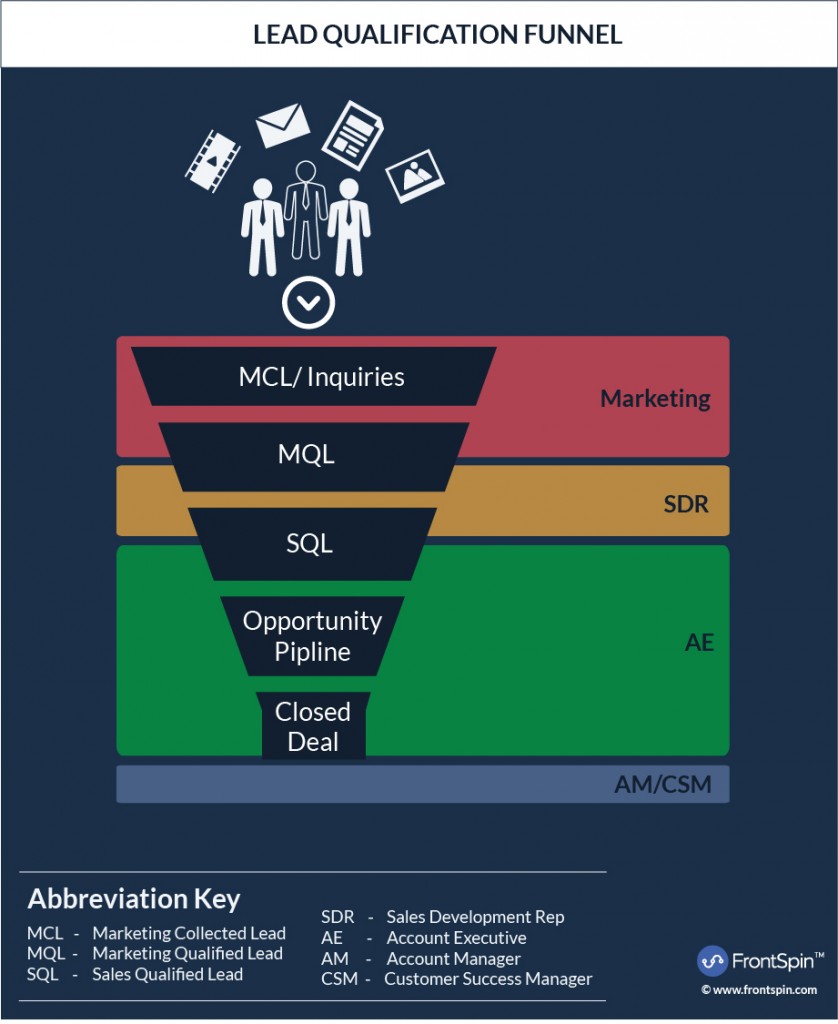

Essential Definitions

Before we start, a few quick definitions, just to make sure that we are all on the same page:

1. MCLs or Marketing Collected Leads

An incoming inquiry collected through marketing. This is a raw lead and needs further qualification before it can be passed further down the funnel (only 4% of marketing-generated leads actually close, according to 47% of B2B marketers).

2. MQLs or Marketing Qualified Leads

An MCL that meets certain standards (such as intent or action) is classified as an MQL. An MQL falls in the ‘second stage’ of the lead qualification process and is more likely to convert to a sale than other inquiries. Once a lead is classified as an MQL, it is ready to be handed over to a human such as an SDR (Sales Development Representative).

3. SQLs or Sales Qualified Leads

The SDR qualifies MQLs based on set criteria (budget, need, authority, etc. – more on this below). Leads that meet these standards are classified as SQLs and are ready to be handed over to an Account Executive (AE).

Some sales organizations use an interim stage between MQL and SQL called ‘SAL’ or Sales Accepted Lead. SAL is a way for AEs to quality check incoming leads and ensure only the most relevant make it to SQL status. More often than not, SALs are grouped under SQL.

4. Opportunities

SQLs that have become real sales opportunities are classified as ‘opportunities’. These are leads that are ready to close, set-up a meeting with, etc.

The Lead Qualification Process in a Nutshell

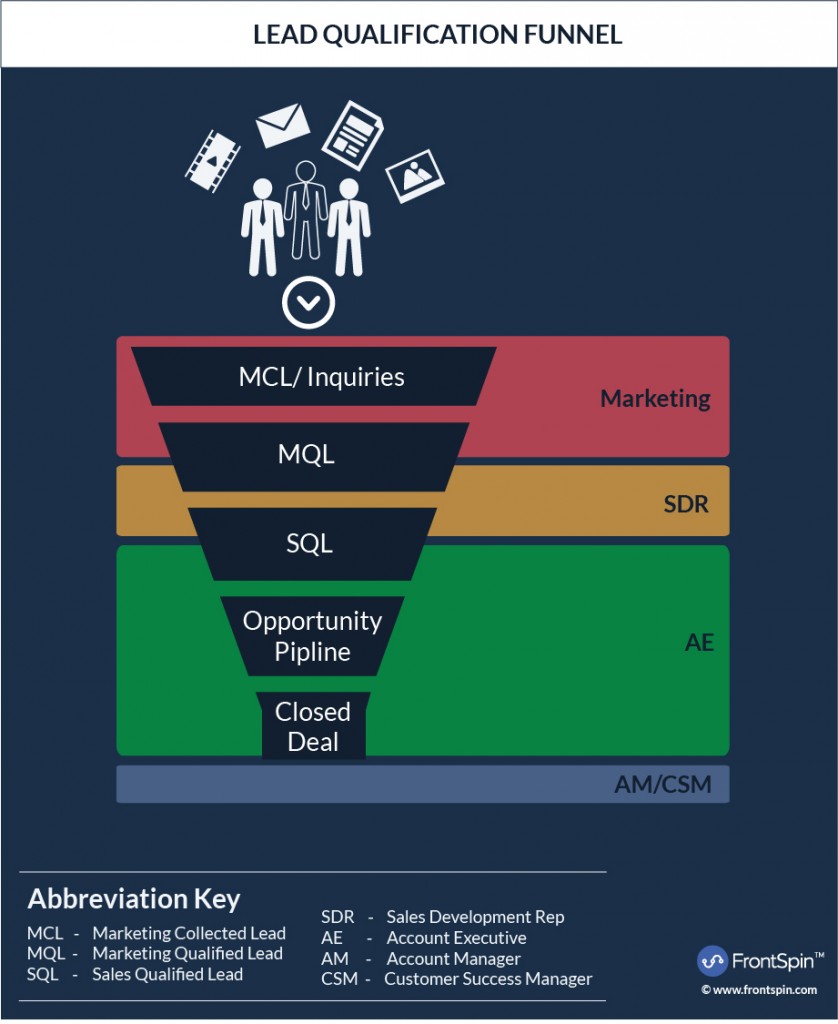

The lead qualification process follows a waterfall model where a prospect enters the top of the funnel as an MCL and exits as a customer (or at least, as an opportunity). At each stage in the funnel, unqualified leads get filtered out, qualified leads are squeezed through.

Consider the following process as an example:

Stage I: A prospect lands on your website and fills out a form. This prospect is now an MCL.

Stage II: An automated lead intelligence tool such as Eloqua or Marketo analyzes this lead and classifies it as an MQL.

Stage III: A SDR takes over and analyzes if this lead is ready to be sold to. If yes, it is qualified as an SQL. Else, it goes back to marketing for nurturing.

Stage IV: Once a lead is classified as an SQL, AEs take over, typically turning the SQL to an opportunity and moving it through the pipeline.

The actual handover from marketing to sales takes place in Stage III. This, as you might imagine, is a big source of conflict in most companies. Much of this stems from a simple question: what really makes an SQL?

The answer? It depends.

What Makes an SQL?

Although the term ‘SQL’ is used widely across industries, it can mean very different things to different organizations.

For example, at a Fortune 500 company I was once a part of, sales always complained that there were “not enough leads”. As a response, marketing started passing off underqualified MQLs to SQLs to account executives. Suddenly, sales had all the leads it wanted, but conversion rates were abysmal. These leads were still ‘SQLs’, but only because marketing relaxed the qualification criteria. The actual lead quality remained unchanged (and hence the drop in conversion rates).

Traditionally, you would classify a MQL as an SQL if it met the BANT criteria:

Budget – Does the lead have the budget to purchase our solution?

Authority – Does the lead have the authority to sign-off on a new deal?

Need – Does the lead need our solution to meet a business challenge?

Timeframe – Do we know when the lead will need our solution?

As you can imagine, getting all this information about a lead is hard. Even if you do manage to get all this data, only 5% of leads are actually in the buying process. Sticking strictly to BANT will often cause your AEs to sit idle, waiting for leads to come through the pipeline.

In such scenarios where your AEs are not operating at full capacity, you might choose to define SQLs with the AN criteria:

Authority – Does the lead have the authority to sign-off on the deal?

Need – Does the lead need our solution?

By removing the requirement for budget and timeframe, your AEs will see more leads at the top of the funnel. However, since you’ve relaxed the qualification criteria, your SQL to Opportunity conversion rate will go down as well. This creates also more work for your AE as they have to manager more leads that are less qualified (though you can mitigate this somewhat by using automated tools like power dialers to reach out to more leads, even if they are not BANT).

As always, there is a trade-off between quality and quantity.

The definition of a SQL, thus, is not constant throughout the industry and the growth of a company. You might start off with an AN scheme when your team is small and lead volume is limited. As your sales team matures and you add more SDRs, you might switch to a BANT or ANUM (Authority, Need, Urgency, Money) to improve lead quality to AEs.

The important part is to constantly optimize the qualification criteria to make sure only the best leads get through to your hunters. At the same time, you must ensure that you have a full pipeline to keep your AEs busy.

To make this delicate balance possible, it is crucial that sales and marketing agree on a shared definition of SQL. Once you agree on a definition, you can work out the balance between quantity vs. quality.

Finally, to answer the original question: what percentage of SQLs should you close?

The short answer, in numbers based on my experience:

- If SQL is a BANT, you should be able to close between 25% and 35%

- If SQL is non BANT, close rates should be between 10% and 20%

The long answer, of course, is “it depends”.

For more insight on marketing stats to consider going into 2021, check out this article.

by Mansour Salame | Feb 25, 2015 | Customer Service, Inside Sales, Inside Sales Team

In his 1776 magnum opus, The Wealth of Nations, Adam Smith predicted a future where division of labor in manufacturing processes would lead to greater productivity and prosperity. His prediction came true within decades as the Industrial Revolution took hold throughout Europe and America, leading to the creation of highly specialized manufacturing jobs.

A similar phenomenon of hyperspecialization is taking place in knowledge worker fields today. Broad job descriptions (“software developer”) have given way to specialized roles (“web developer”, “mobile developer”, “front-end developer”, etc.). This isn’t unlike Taylorism in industrial manufacturing at the end of the 19th century.

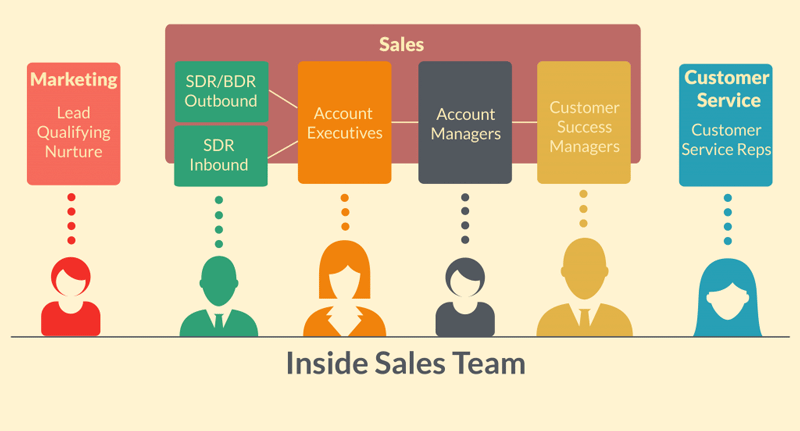

Naturally, this hyperspecialization has affected inside sales teams as well.

Hyperspecialization of Inside Sales Team in B2B Software

As I wrote in my last post, the first inside sales teams set up appointments for field reps. As communication tools improved, some of these inside sales reps started closing small deals over phone and email. Their success led to companies creating small inside sales divisions. These had simple hierarchies – usually a handful of salespeople prospecting, closing and managing deals among themselves with no strict division of responsibilities.

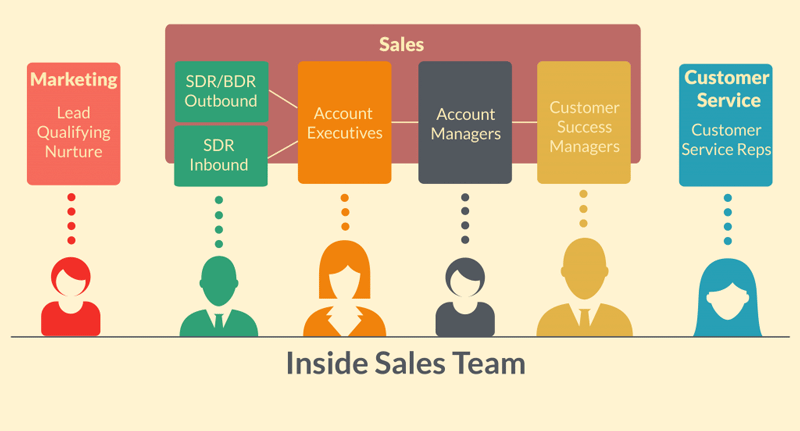

The modern inside sales team is a different beast altogether. For most B2B software companies, the inside sales team is broken up into four or five distinct roles:

1. Sales Development Representative – Inbound Lead Qualification: The chief responsibility of inbound SDRs is to qualify inbound leads and set up appointments for Account Executives. All incoming leads are categorized as “ready to buy” and “not ready to buy, with the former going straight to Account Execs for closing. A well-run B2B software company can receive a large number of inbound leads every day. Speed of response and deep lead qualification, thus, are desirable metrics for measuring inbound SDR performance. Sometimes the inbound lead qualification function is in Marketing, as is Lead Nurturing.

2. Sales Development Representative – Outbound Demand Generation: Outbound SDRs are involved in demand generation, i.e. they find qualified targets where no existing relationship exists and set up meetings or demos with account executives. Outbound SDRs are sometimes grouped by territory or product, but usually have a lot of freedom in how they choose to go about their business. Outbound SDR can be very effective for B2B software startups. As Aaron Ross points out in Predictive Revenue, outbound prospecting was largely responsible for earning Salesforce an additional $100m in revenue.

3. Account Executives: Account Executives are responsible for closing deals. They handle all qualified leads until they turn into paying customers. Because they are responsible for landing a new logo, they are sometimes called “hunters” within sales organizations. You will often see job ads for account executives asking that applicants have a “hunter” mentality.

4. Account Managers (AM) The primary responsibility of Account Managers is to make sure that customers stay with your company. They are also responsible for generating as much revenue from the customer as possible (this includes getting referrals). Because of this, AMs are sometimes also called “farmers”, since they must “farm” customers and extract maximum value from them.

5. Customer Success Managers (CSM): Customer Success Manager (CSM) take a proactive customer service role. The CSM’s job is to make sure that the customer doesn’t churn and for maximizing Customer Lifetime Value. In most sales organizations, they don’t have quotas, nor do they handle renewals and upsells (which is the Account Manager’s job).

What is the Difference Between Customer Success Reps and Customer Support Reps?

If you look at the job descriptions for Customer Success Managers and Customer Support, you might see a few similarities. There is certainly some overlap between the two roles, yet, Customer Support and Customer Success are two different endeavors, each with different end goals.

Historically, B2B technology products required large-scale deployments and heavy investment upfront. This upfront investment “locked in” the customer and the vendors could be reactive in providing support. That is origin of most Customer Support Teams in B2B tech companies. And the primary goal of Customer Support is to respond to a customer identified problem within a given service level.

The concept of Customer Success owes its origin to the growth of SaaS software. With SaaS, customers can spend only a few dollars upfront and test out a service on a monthly basis. Converting such “trial” accounts into long-term, high-value paid accounts and retaining those accounts is a top priority for any inside sales team. The CSMs make sure that customers are getting the most out of the product or service. This isn’t a reactive problem Customer Support can solve. It requires a proactive consultative approach and the holistic overview that Customer Success Managers bring to the table.

In most businesses, CSMs are responsible for a high-level understanding of the customers’ health within a sales organization. For this reason, they seldom carry any quotas; their chief job is to extract maximum value from customers and to make sure they don’t churn. The key metric for them is Customer Lifetime Value, rather than the number of closed tickets handled. CSMs are also responsible for community development and turning customers into cheerleaders, who, in turn, can bring in those 9 and 10 NPS scores and provide referrals.

Customer Support, on the other hand, is responsible for reactive problem solving. These are the people who handle errors, solve technical issues and answer questions. They deal with issues on a case-by-case basis and don’t have the macro view that CSMs have. Their primary job is to solve break-fix problems, not pitch additional products, get referrals, or reduce customer churn.

Think of it this way: Customer Support is reactive and Customer Success is Proactive

It’s may seem like a subtle difference, but it could mean the world in your success.